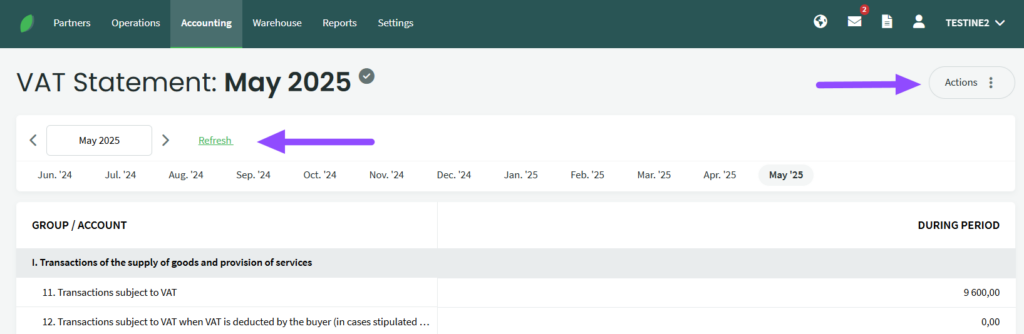

HOW TO FIND? – From the main menu “Accounting -> VAT statement”

The content of the value added tax report is almost identical to the VMI EDS VAT return form. With a proper configuration of SimplBooks, the value added tax return data can be transferred to both VMI EDS and I-SAF systems.

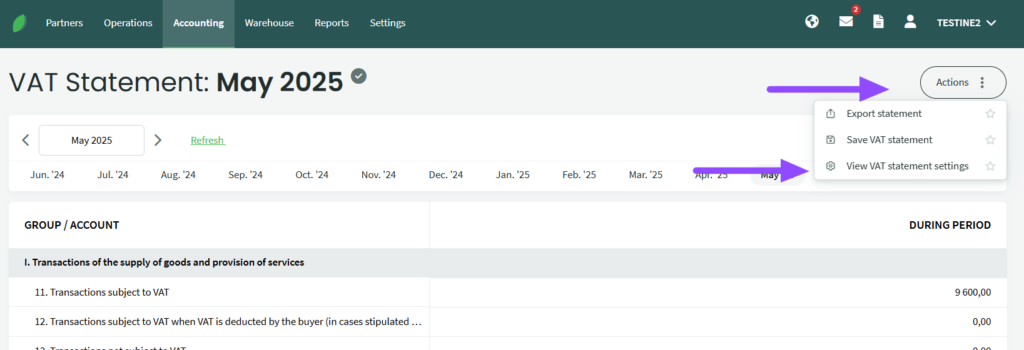

To export the report data, click on the “Actions” – “Export report” button in the header and select the ISAF data or VAT (FR0600) report file. The exported report can be uploaded to the VMI system. Please make sure that you are exporting the report for the correct month. You can change the date by selecting the correct month of the report.

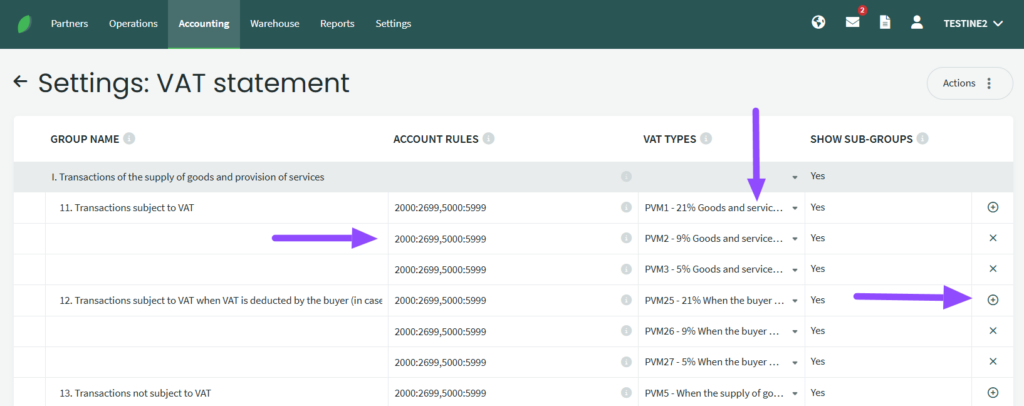

To change the settings of the VAT report, use the “Actions” button in the header of the report and select “View VAT report settings”. Clicking on it will open the report settings view.

Value added tax reports are usually configured in the same way as other accounting reports. If you want to change the accounting accounts for which data is included in the report, please edit/enter the relevant accounts in the column “Account rules”. If you want to adjust the VAT types, select the desired VAT code in the column “VAT type”. If you want to add or delete rows, click “+” to add or “x” to delete on the right hand side. Once you have made your changes, click “Save settings” at the bottom of the report

The value added tax report is pre-configured with an initial chart of accounts for standard sales and purchase transactions.

If you have any questions, please contact us at support@simplbooks.lt.

Leave A Comment?