There are two options in the SimplBooks system for entering the sale of fixed assets.

A) if the sales invoice has already been entered, then it is possible to specify a connection on the fixed asset information sheet

B) if you are currently entering or changing the sales invoice, then the connection to the sale of the fixed asset can be specified on the sales invoice

A) entry of the connection for the fixed asset sale from the fixed asset information sheet

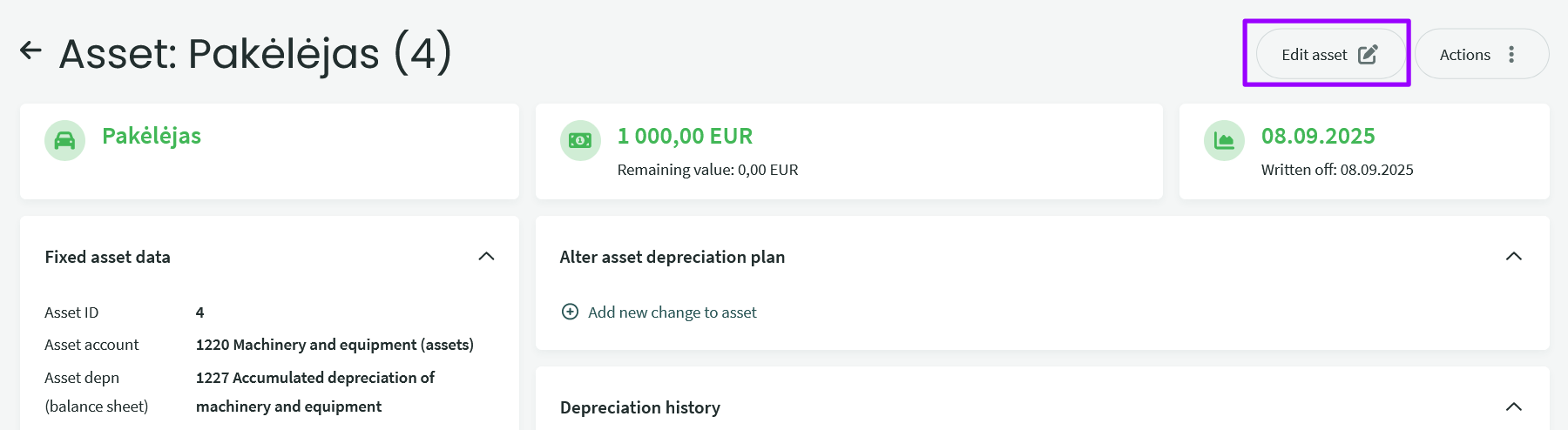

If the sales invoice has already been entered but has not yet been associated with the fixed asset, then open the list of fixed assets from the main menu “Accounting – Assets” and click on the sold fixed asset’s row Then select “Edit asset” it the top right corner.

Note: when creating sales invoice in “Contents” line You have to write exact Asset name.

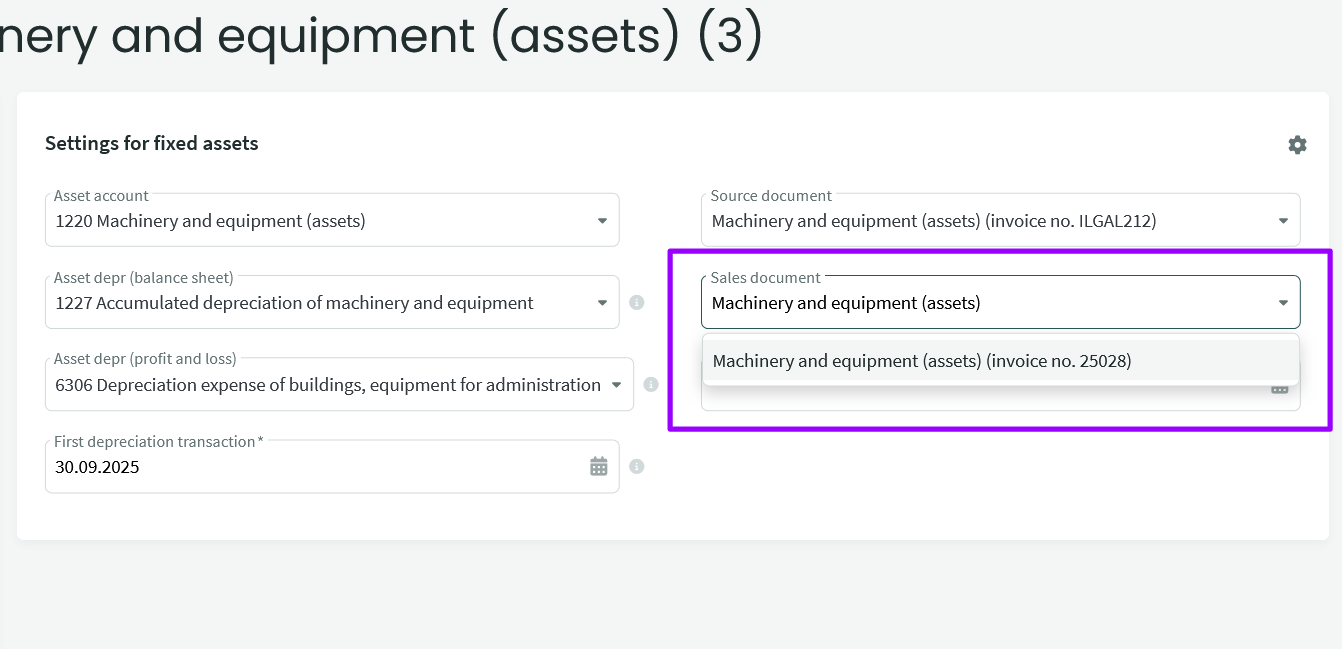

In the edit view, directly below the selection area on the source document (purchase invoice row) there is now a field “Sales document” where you can enter the specific sales invoice row with which the fixed asset was sold. To do so, simply begin to type the sales invoice row content on the sales document and the system will automatically offer suitable variants from which you can make a selection.

After selecting a suitable sales invoice row for the sales document field, the fixed asset write-off date field is also completed automatically, the value of which is the date on which the sales invoice was prepared.

After specifying the sales document, click on the button “Save fixed asset”.

B) entry of the sales invoice along with the sale of the fixed asset

Essentially, this is a same sale of goods, but you also need to link it to the fixed asset card.

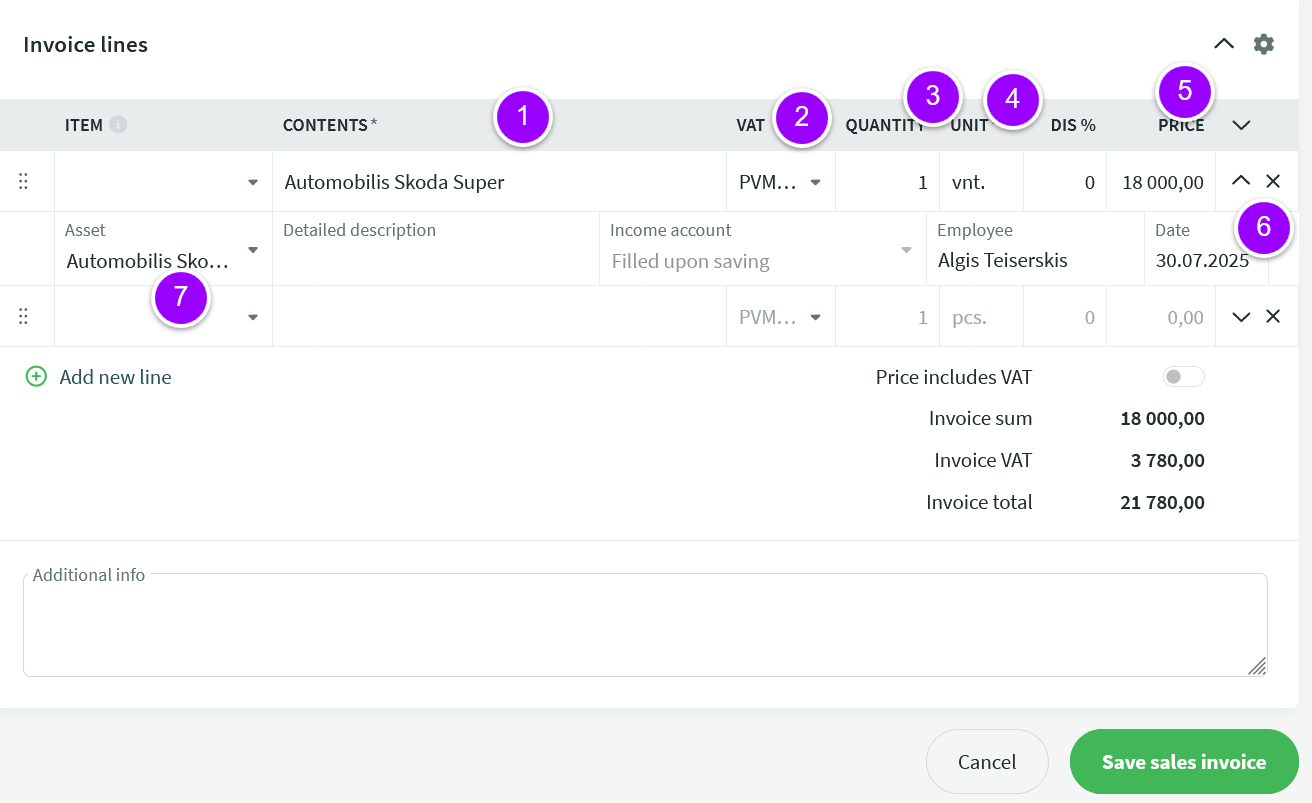

Create a new sales invoice and setup:

- In the “Content” field, enter the name of the fixed asset you want to sell (the “Product” field remains empty)

- VAT type: standard 21% – VAT1 (if the asset is sold in Lithuania)

- The quantity is always 1 unit, because the invoice must be linked to the fixed asset card

- The “Unit” must always be “pcs”

- Enter the sale price of the asset

- Clicking on the arrow will open additional fields

- In the “Asset” field, start typing the name of the asset and when the desired asset appears, select it by clicking on it.

Please note: to ensure that all accounting operations are recorded correctly, check that you have specified all the necessary accounts in the “Asset” column (menu ‘Settings’ – “Automatic operations”). For more detailed information on entering assets, see Entering fixed assets.

If the sales invoice rows and other fields are completed, then click on the “Save sales invoice“ button at the bottom of the form.

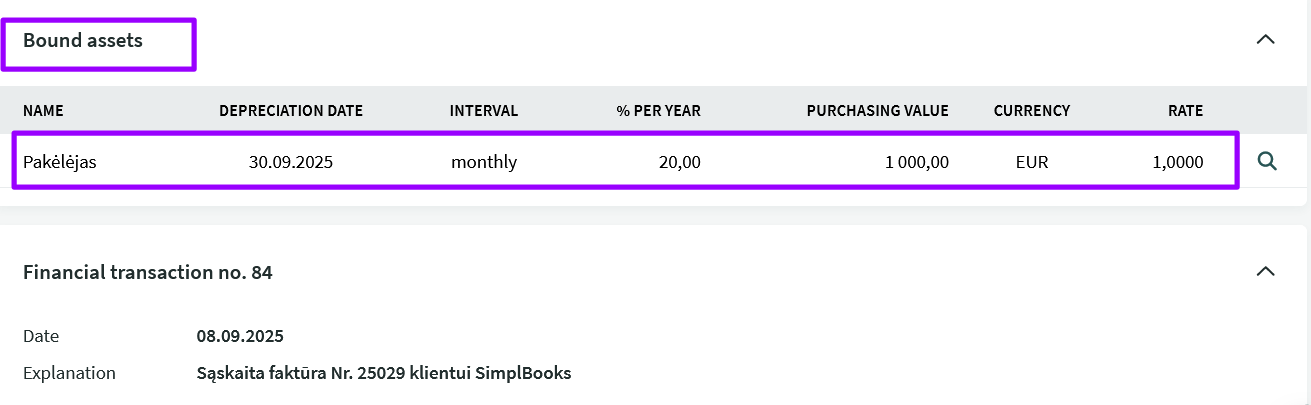

If saving is successful, then the associated fixed asset will also be displayed in a separate panel in the sales invoice view.

Saving the sales invoice will also result in changes to the associated fixed asset entries, such that entries for the sale and write-off of fixed assets will be prepared.

Automatic financial entry accounts associated with the sale and write-off of fixed assets can be affected through the settings for automatic entry “Settings > Automatic transactions > Fixed assets“.

For more information, write us support@simplbooks.lt

Leave A Comment?