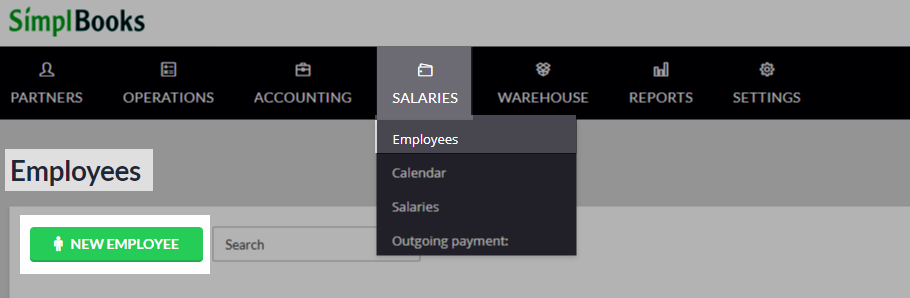

New employees can be entered by selecting from the main menu “Salaries -> Employees”. Then click on “New employee” in the top left corner.

This opens a form for adding a new employee, which is divided into three sections: main details, address and bank details, and employment data. Let’s have a closer look at each section.

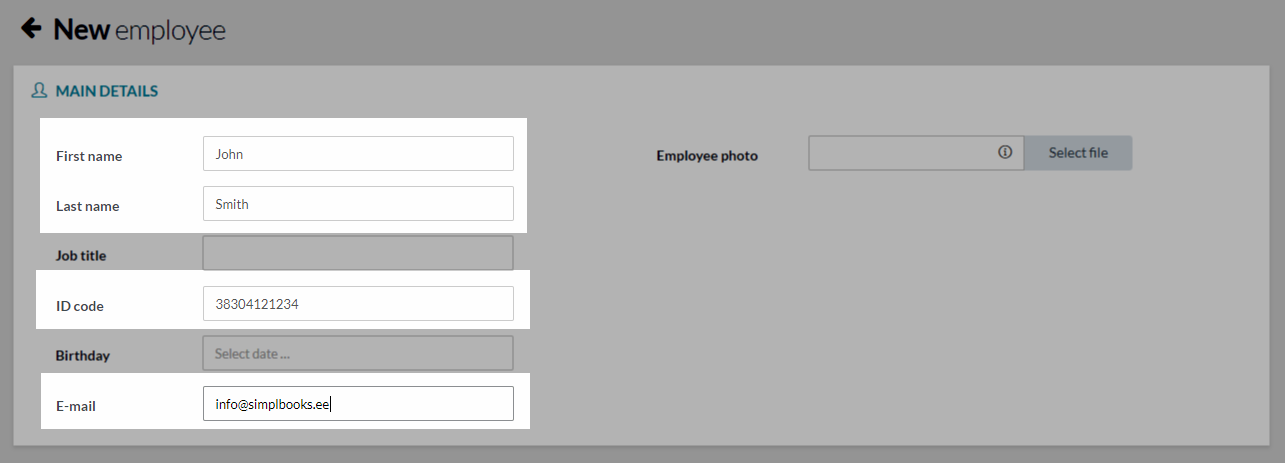

Main details

The most important fields here are the first name, last name, ID code and e-mail. Everybody probably understands the importance of having fields for names, which should be filled in correctly because this is how they will appear in reports as well as, for example, bank payment files. The ID code is mostly necessary when exporting TSDs for the Tax Board, or in other words when preparing an XML file which can be uploaded to the emta.ee website. If the ID code is missing, the salary of the relevant employee cannot be uploaded to the Tax Board. And lastly, the e-mail is necessary if you want to send payslips to employees directly from SimplBooks. In order to send a payslip you do not necessarily have to define the e-mail on the employee information sheet as this can also be done directly on the payslip form.

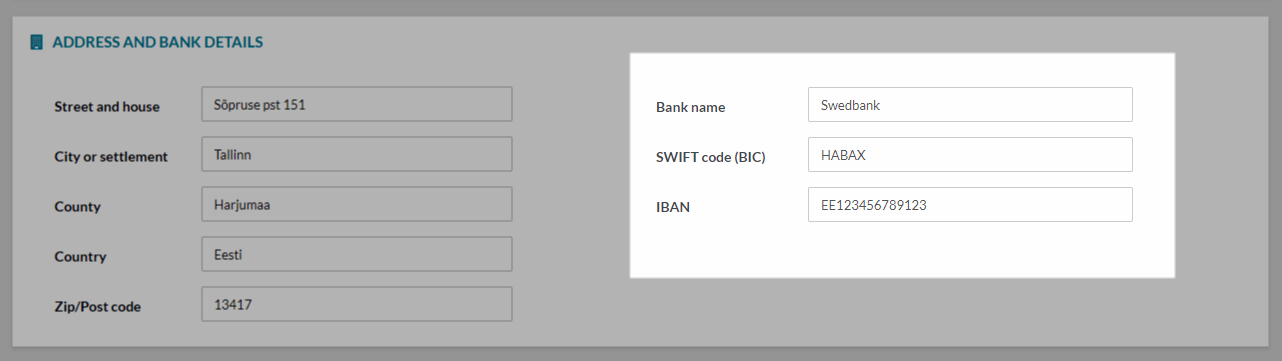

Address and bank details

In this section only bank details are important for the system, but even they are not required. Bank details are necessary if you want to prepare a payment file for salary, which can be imported to the bank.

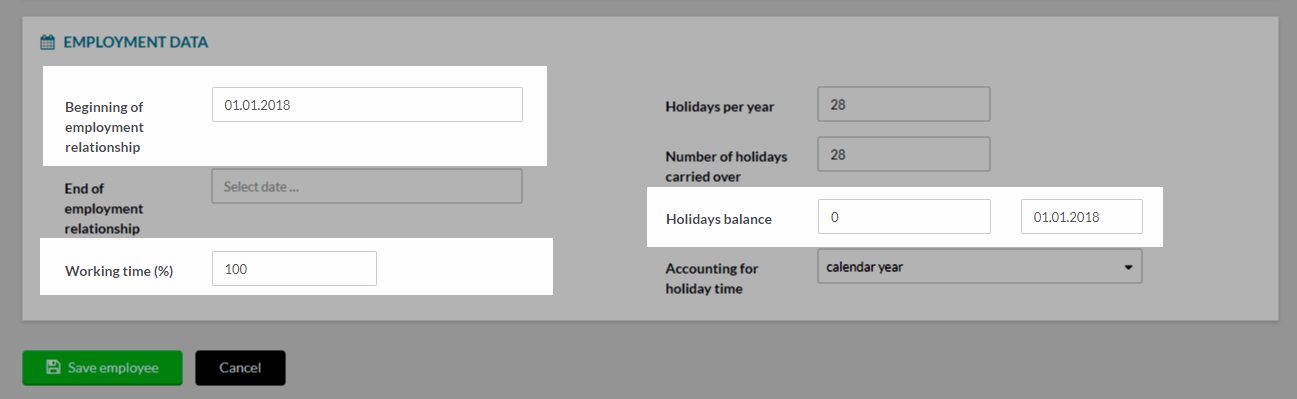

Employment data

The fields in the last section are the most important ones for the system. You should definitely set the beginning of the employment relationship and the working time which is usually 100%. Holidays per year equal 28 for regular employment contracts and the same goes for the number of holidays carried over. The latter arises from the fact that holidays earned during a year can be used until the end of the year following the calendar year during which the holidays were earned. It is also important to set out the holidays balance as of X (date). For new employees the holidays balance should be 0 and the date should be the date of the beginning of the employment relationship. If you are transferring your accounting to SimplBooks, the balance and balance date should be the date of the initial balance.

After new employee has been saved

After the employee information sheet has been saved it is possible to associate with the employee further data that mainly helps to calculate salary easier and more automatically. For example, if the employee is paid agreed monthly salary, we recommend that you set out this salary on the employee information sheet under “Employee salaries” by clicking on the grey button “Add new” in the corner. We additionally recommend setting the taxes applicable to the employee, especially if you want to determine the income tax free part applicable to the employee. This can be done under “Applicable taxes” by clicking on the grey button “Set up”.

The employee salaries and taxes settings are not required, but they are recommended to make the salary calculation easier.

Leave A Comment?