In the sample images, some fields have been deactivated, which may result in a view different from the one in your environment.

For more information on configuring the invoice transaction view, please refer to the guide Adding sales invoice.

- To enter a new invoice, go to the Operations menu and select Sales invoices. In the list view, there is a button labeled “New invoice”.

- Alternatively, you can use a keyboard shortcut. To add a new sales invoice, use the combination Ctrl+I. If you are currently in the sales invoice view (on a saved sales invoice), the Ctrl+L combination also works

If your company is not a VAT payer, this must be marked in the company profile.

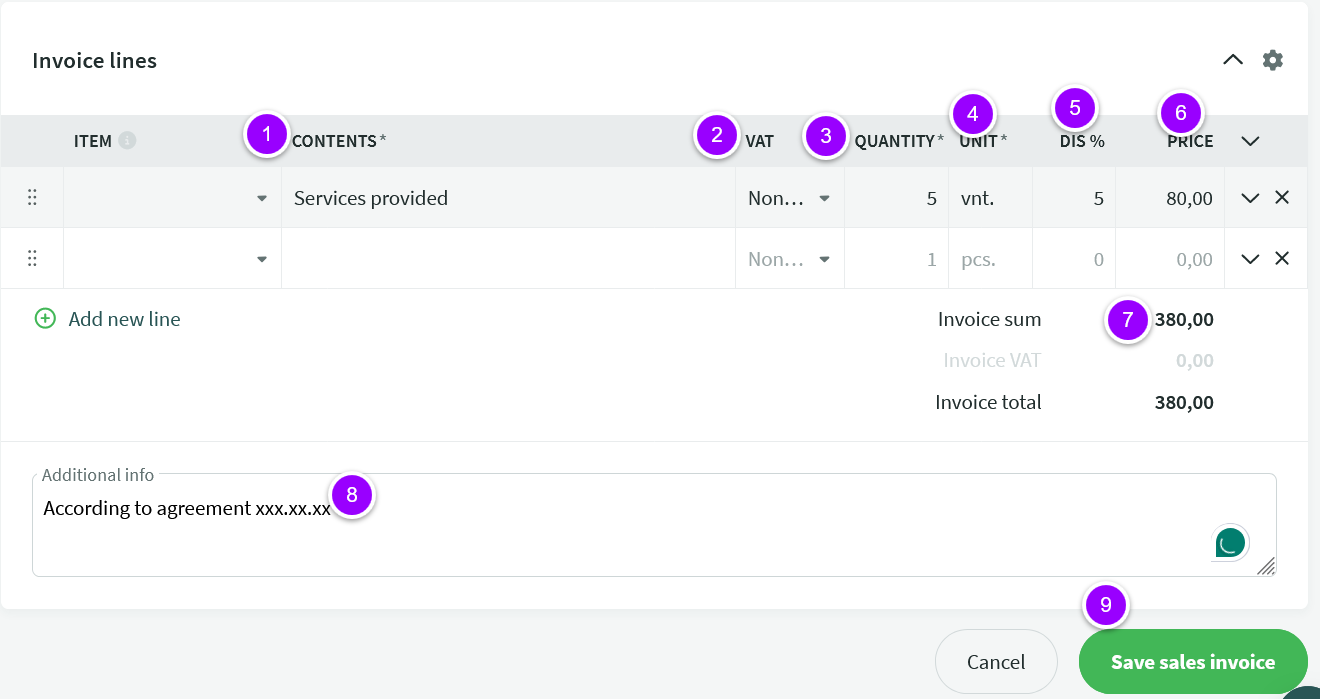

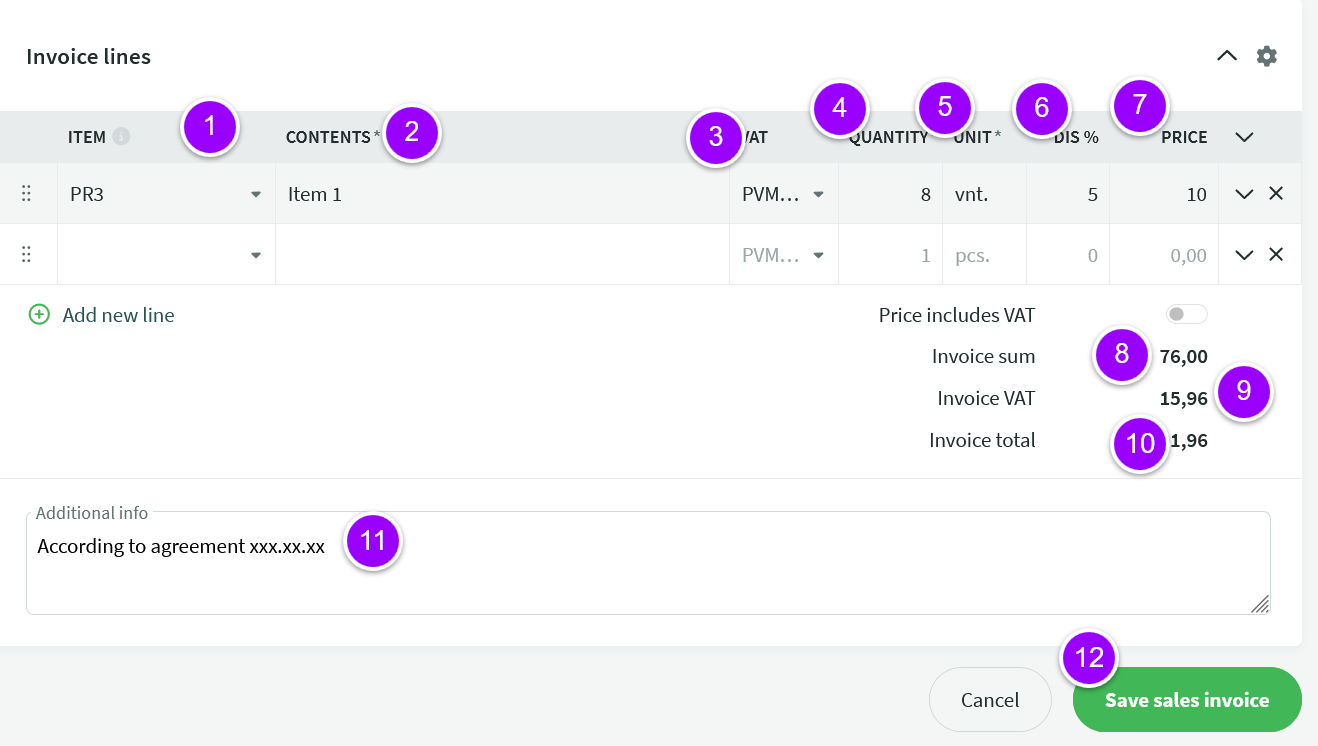

- Fill in the invoice line content. When filling out the service, it is sufficient to fill in the “Content” column.

- The VAT type cannot be changed, nor is there a need to do so (because company are not VAT payer)

- Enter the quantity

- The unit field is pre-filled with “pcs” (pieces), but you can change it as needed.

- Enter the discount % if applicable

- Specify the price

- The invoice amount is calculated automatically

- Additional information field that will be reflected in the invoice. Can be filled in automatically if specified in “Environment settings”

- After filling in the data, save the invoice

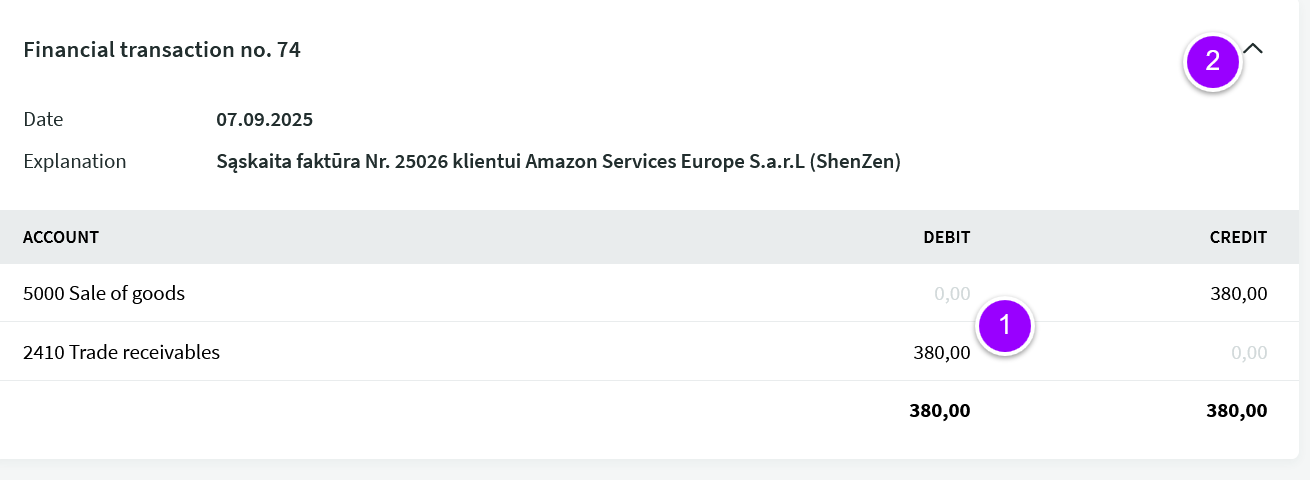

To view the accounting accounts for the invoice (1), scroll down to the bottom of the page. If the accounts are not visible, click on the arrow next to “Financial transactions” (2).

- If you are selling a service, you do not need to fill in these lines. However, if you have entered the product as a service, you can select it in this field (when creating a warehouse product, mark “Service product” on the card).

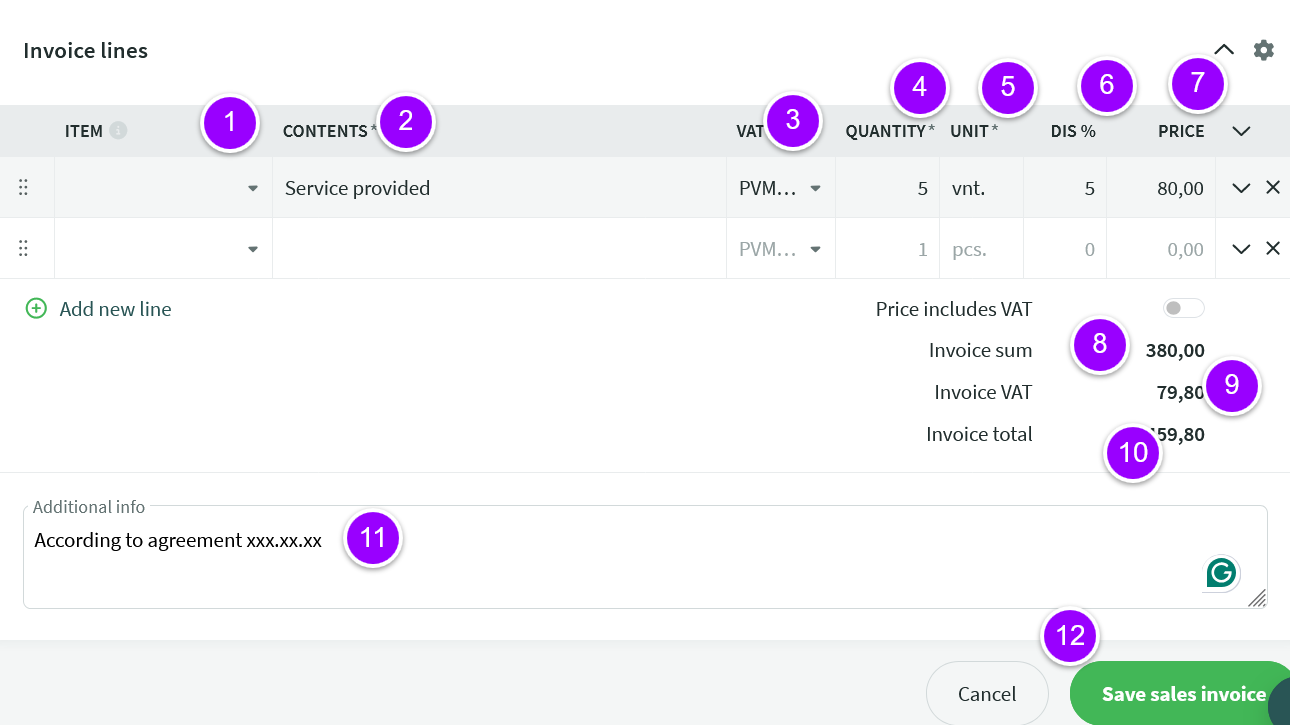

- Fill in the invoice line content

- When selling services in Lithuania, the most commonly used VAT code is PVM1 – (21%). Depending on the selected VAT type, a different VAT rate and corresponding invoice are calculated (if “Environment settings” are set correctly).

- Enter the desired quantity

- The field is filled in as “units” by default, but you can change it as needed.

- Enter a discount, if applicable

- Specify the price

- Invoice amount. Above this field, you can choose to have the service price calculated with VAT included (click on the “VAT included in price” option) – in this case, VAT will be deducted from the specified price

- VAT amount

- Total amount with VAT

- Additional information field that will be reflected in the invoice. Can be filled in automatically if specified in “Environment settings”

- After filling in the data, save the invoice

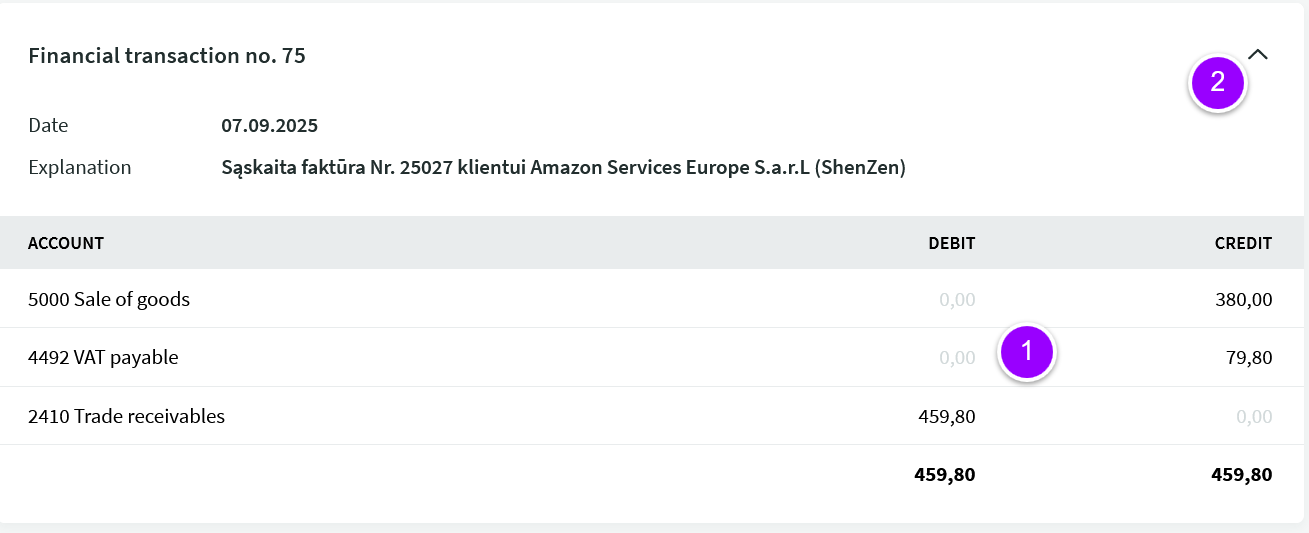

To view the accounting accounts for the invoice (1), scroll down to the bottom of the page. If the accounts are not visible, click on the arrow next to “Financial transactions” (2).

- Select a product from the list if you have entered it into the products (Warehouse – Products. Be sure to specify the “Sales revenue” and “Active warehouse” accounts on the product card. Products cannot be sold at a loss)

- The content will be filled in automatically if you have selected the item from the list of items already entered. If you have not selected the item, you can enter the name of the item in free form here

- When selling goods in Lithuania, the most commonly applied VAT type is VAT1 – 21%. Depending on the selected VAT type, a different VAT rate and corresponding invoice are calculated (if “Environment settings” are specified)

- Enter the desired quantity

- The field is filled in as “units” by default, but you can change it as needed

- Enter a discount, if applicable

- Specify the price

- Invoice amount. Above this field, you can choose to have the service price calculated with VAT included (click on the “VAT included in price” option) – in this case, VAT will be deducted from the specified price

- VAT amount

- Total amount with VAT

- Additional information field that will be reflected in the invoice. Can be filled in automatically if specified in “Environment settings”

- After filling in the data, save the invoice

To view the accounting accounts for the invoice (1), scroll down to the bottom of the page. If the accounts are not visible, click on the arrow next to “Financial transactions” (2).

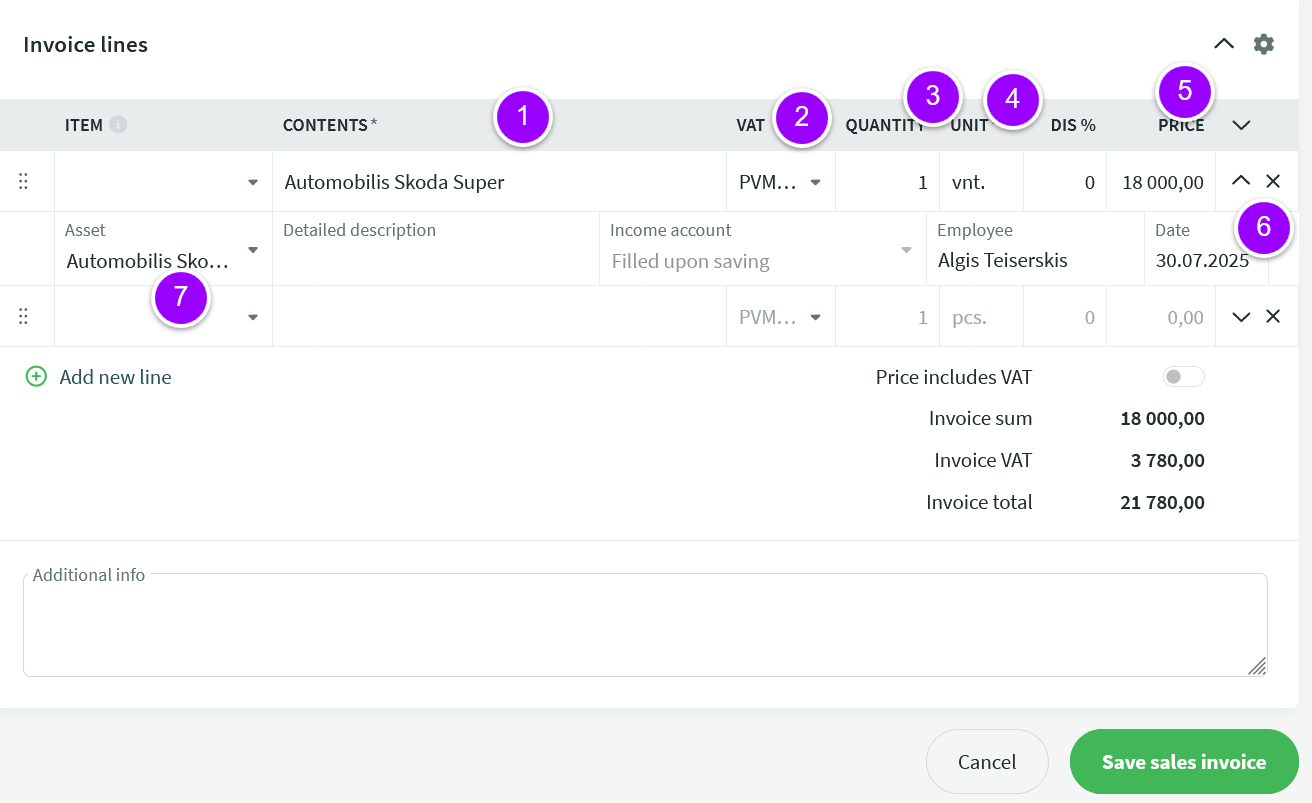

Essentially, this is a sale of goods, but you also need to link it to the fixed asset card

- In the “Content” field, enter the name of the fixed asset you want to sell (the “Product” field remains empty)

- VAT type: standard 21% – VAT1 (if the asset is sold in Lithuania)

- The quantity is always 1 unit, because the invoice must be linked to the fixed asset card

- The “Unit” must always be “pcs”

- Enter the sale price of the asset

- Clicking on the arrow will open additional fields

- In the “Asset” field, start typing the name of the asset and when the desired asset appears, select it by clicking on it.

Please note: to ensure that all accounting operations are recorded correctly, check that you have specified all the necessary accounts in the “Asset” column (menu ‘Settings’ – “Automatic operations”). For more detailed information on entering assets, see Entering fixed assets and Sale of fixed assets

In the case of Intra-community supply of goods and services, the buyer is a company from another European Union member state that is registered for VAT in their country. Before issuing the first invoice, you should definitely verify the validity of the VAT registration number provided to you. You can do this on the European Commission’s VIES VAT number validation website.

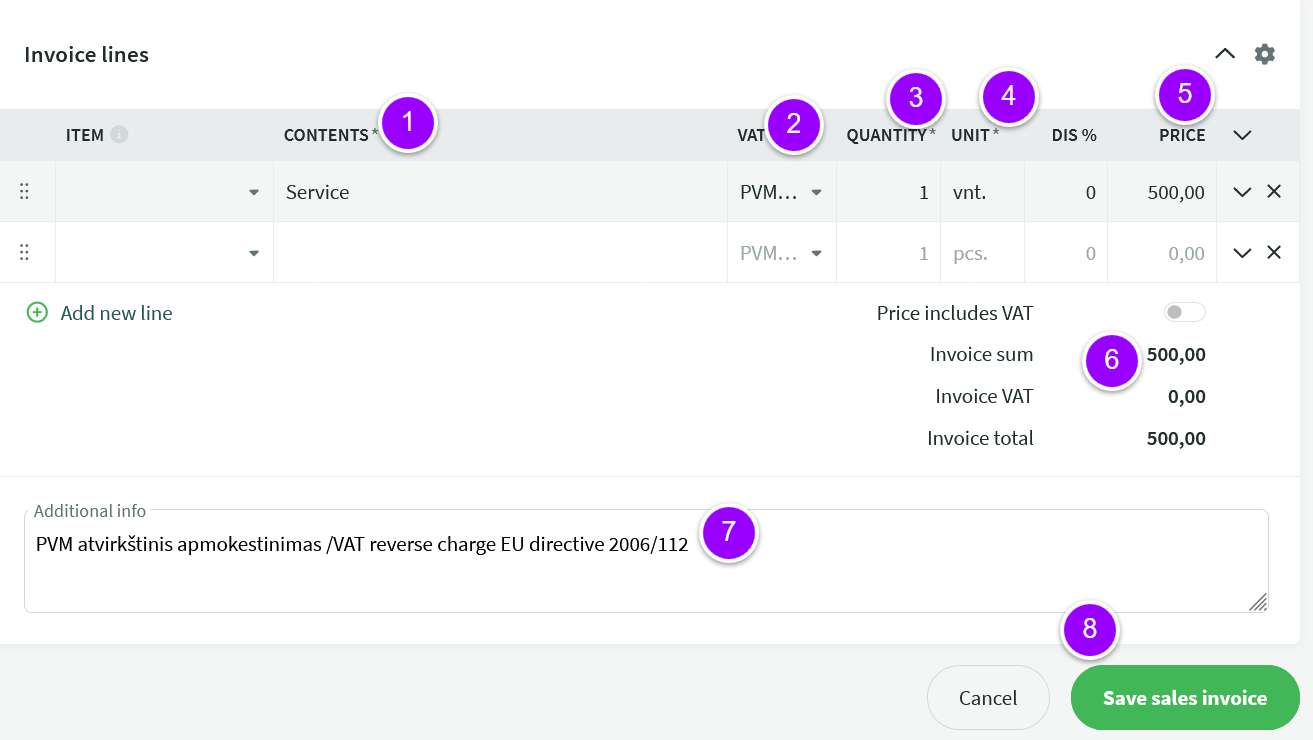

- Describe the service being sold (if you have entered the item as a service in the warehouse, specify it by selecting it in the “Item” row)

- Select code PVM15. When the service is sold to the EU or another country, VAT is not calculated for the VAT payer. Depending on the selected VAT type, the corresponding accounting account may differ if this is specified in the VAT class (in the “Settings” menu – “Environment settings” – “VAT classes” – click “Edit” next to the selected class and specify the accounting account)

- Enter the desired quantity

- The field is filled in as “units” by default, but you can change it as needed

- Specify the price

- Since VAT is not calculated, the same amounts are shown in the “Invoice amount” and “Total” lines

- LIt is recommended to enter an additional reference in the field: “VAT reverse charge EU directive 2006/112″

- Save the invoice

The sale of goods to a customer who is a VAT payer in an EU country is carried out in the same way as the sale of services to the EU (see point 5), the only difference being the VAT field (2) – it contains the VAT13 code – 0% for goods supplied to EU VAT payers. All other points remain the same. It is also recommended to include an additional reference in the invoice: “PVM atvirkštinis apmokestinimas /VAT reverse charge EU directive 2006/112”

The sale of goods to a customer who is outside EU country is carried out in the same way as the sale of services to the EU (see point 5). Fill in the description in the “Content” field or select a product from the warehouse in the “Product” field (please note: be sure to specify the sales and active warehouse accounts on the product card. Products cannot be sold at a loss). For the export of goods to third countries, specify the VAT code PVM12 – export of goods

If You have more questions, please contact us support@simplbooks.lt

Leave A Comment?