There are several ways to mark a credit invoice as paid:

Option 1. “automatic”. After saving the Credit invoice, a window will pop up asking if you want to offset the invoice against the credit account – click “Yes”. If you have set up an offsetting account in your settings, the purchase account and the credit account will be automatically linked.

Option 2. If the credited sales invoice has been paid (invoice status: paid) and the payment has been made in the bank/cash register on the basis of the credit invoice.

Option 3. If the sales invoice is not paid and no refund has been made in the bank on the basis of the credit invoice created for it. That means no money has actually been moved.

More detailed:

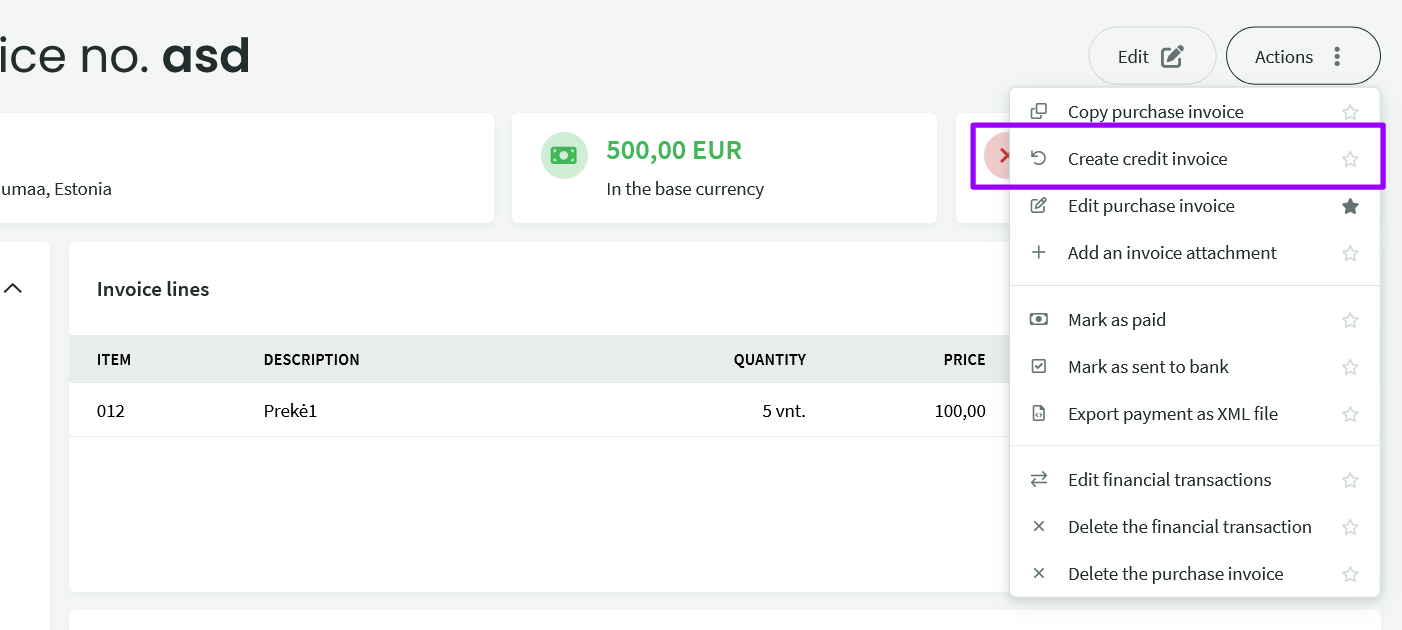

For option 1 : open the desired purchase invoice, click “actions” – “Create credit account” – the new invoice window will open.

After entering and saving the credit invoice (with a minus sign), a window will pop up with the question “Should the account be offset with the credit account?” – click “Yes.” If you have entered the Offset account in the settings, the purchase account and credit account will be offset automatically. Read more about this method here.

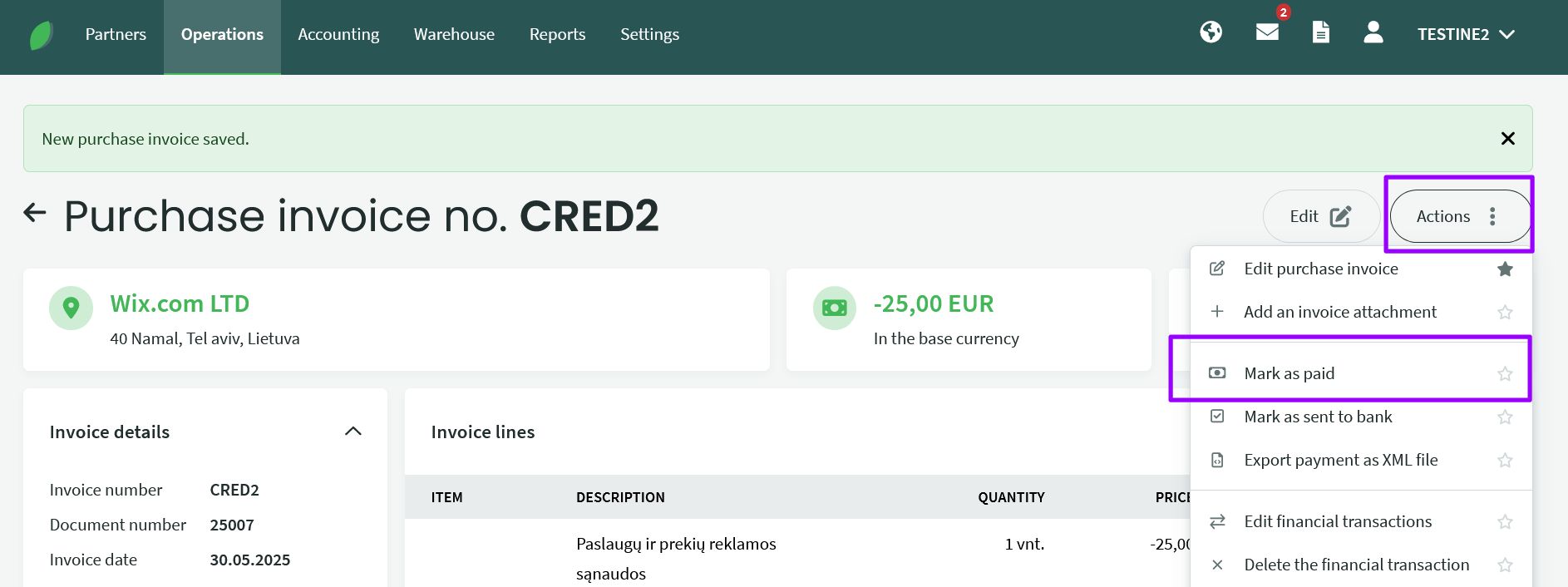

For option 2: Open the selected credit invoice by clicking on the invoice line. Click “Mark as paid”

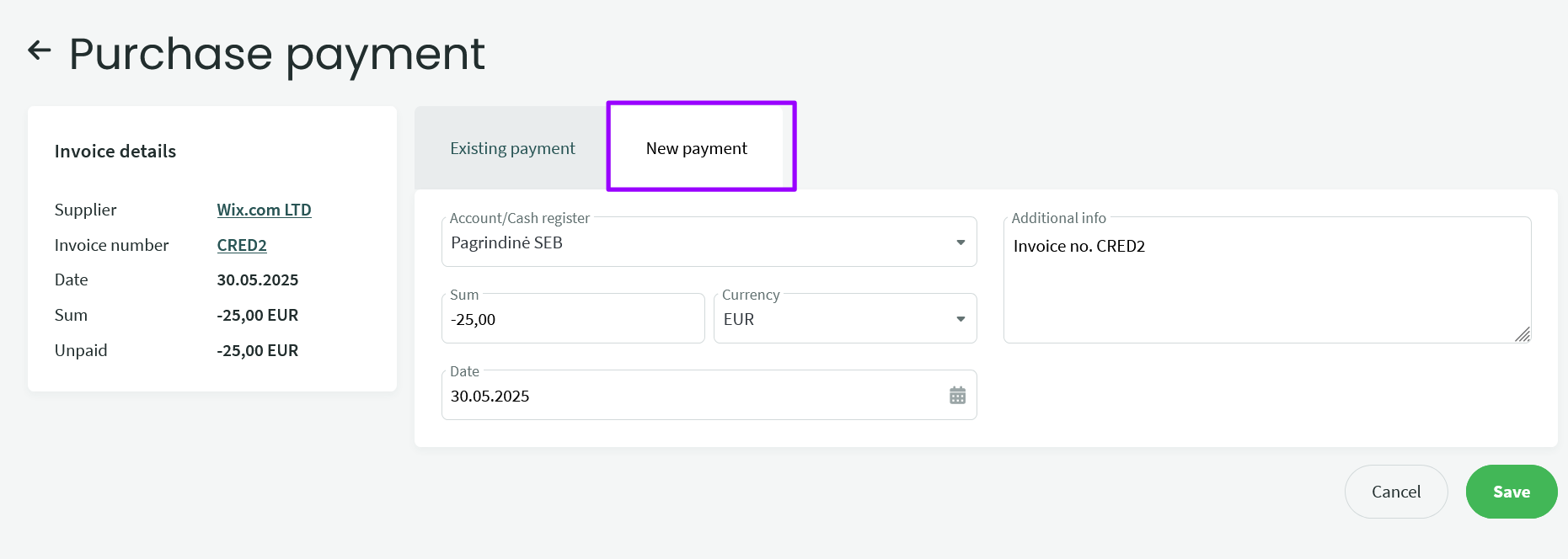

You must select on the next page the bank account in the “Account/Cash register” field from which the credit invoice was paid or create a new payment (this method is the same as regular invoice payment). Set the date when the credit invoice was paid. Click “Save”

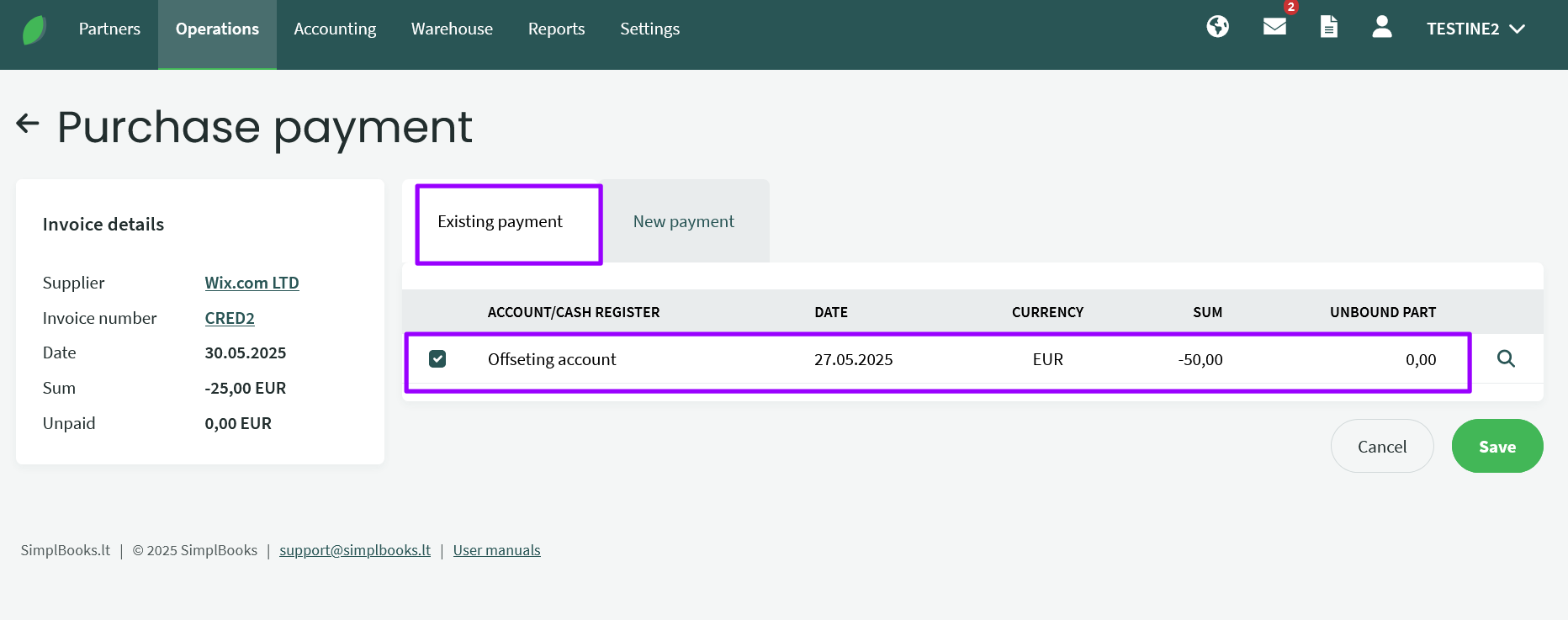

For option 3 you must select “Offsets” in the “Account/Cash register” field. Set the same date as is set as the date of the credited invoice.

In the Expenses section, create a new payment, select “Offset account” (see explanation below), enter the amount with a minus sign, click “Save” and offset with credit Invoice or select “Mark as paid” in the invoice, select “Existing payment,” and check “Offset account”, click “Save”

In the same way, make a “payment” via the Offset account to the regular account. This will offset both accounts.

Note! – Offsetting account You can create edit in menu Settings – Account and cash – create new account or edit an existing one. For the financial statement, select any off-balance sheet account, for example “9999”.

For additional questions, please write to us at support@simplbooks.lt

Leave A Comment?